By Hope Hamashige

Zuleima Hidalgo, a student in the USC Division of Biokinesiology and Physical Therapy, was in attendance at the White House on Aug. 9 when President Barack Obama signed into law a student loan reform bill.

Hidalgo, who is about to enter her second year in the Doctor of Physical Therapy (DPT) program, was one of several students asked to attend the signing. Prior to putting his signature on the legislation, Obama thanked the students who had raised their voices in support of the legislation.

“Without their voice, without their participation, we probably would not have gotten this bill done,” Obama said.

Hidalgo said it was an incredible honor to stand behind Obama as a witness to history.

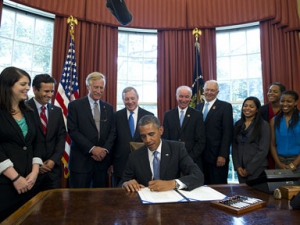

USC physical therapy student Zuleima Hidalgo (third from right) looks on as U.S. President Barack Obama signs a student loan bill to keep students’ interest rates low during a signing ceremony in the Oval Office of the White House in Washington, D.C., on August 9.

(Photo/Saul Loeb/AFP/Getty Images)

“To witness our president sign something that I was so passionate about made me feel so proud, as well as happy, to know that our Congress could come to an agreement,” she said.

Hidalgo also got the chance to meet the president and tell him how grateful she is for the passage of this bill.

The Bipartisan Student Loan Certainty Act of 2013 retroactively lowered the interest rate on student loans disbursed after July 1, regardless of whether they are subsidized or not. The bill lowered the interest rate for loans to undergraduates from 6.8 to 3.9 percent and for graduate students to 5.4 percent. Interest rates on graduate student loans, depending on the type, have been reduced to between 5.4 and 6.4 percent for the life of the loan.

Future student loan rate increases will be tied to financial markets, but they will not exceed 8.25 percent for undergraduates and 9.5 percent for graduate students. Because of the new legislation, estimates are that nearly 11 million students across the United States will see their interest rates drop.

Jason Murillo, a USC financial aid officer, noted that “the new lower rates will result in thousands of dollars in savings over the life of these loans.”

President Obama said during his remarks that student loan debt, which has ballooned in recent years, burdens new graduates, their families and “has a depressive effect on the economy overall.” He added that student loan debt makes it harder for recent graduates to buy homes or start their own businesses.

Hidalgo said she expects this measure to be a major benefit to her, as well as her classmates, once she completes her degree.

“Honestly,” she said, “this alleviates some of the pressure that my classmates and I will face to pay off our loans as quickly as possible so that we don’t accumulate too much interest.”

Not only does she see the new legislation as a boon for students, she also sees it as a help to the continuing recession.

“If college is affordable, then that means less debt that America will be in,” she added. “That means students will be more prone after graduation to buy a house, to buy appliances and furniture, to buy a car — those are all things that help keep the economy going.”